A need for greater liquidity among some investors is driving activity in the real estate secondary market.

Real estate secondary transactions involve the trading of interests in private property portfolios, funds or single assets from existing investors. The market creates liquidity for what are typically illiquid deals. The market also creates diversification opportunities for investors if they opt to spread investments among more deals.

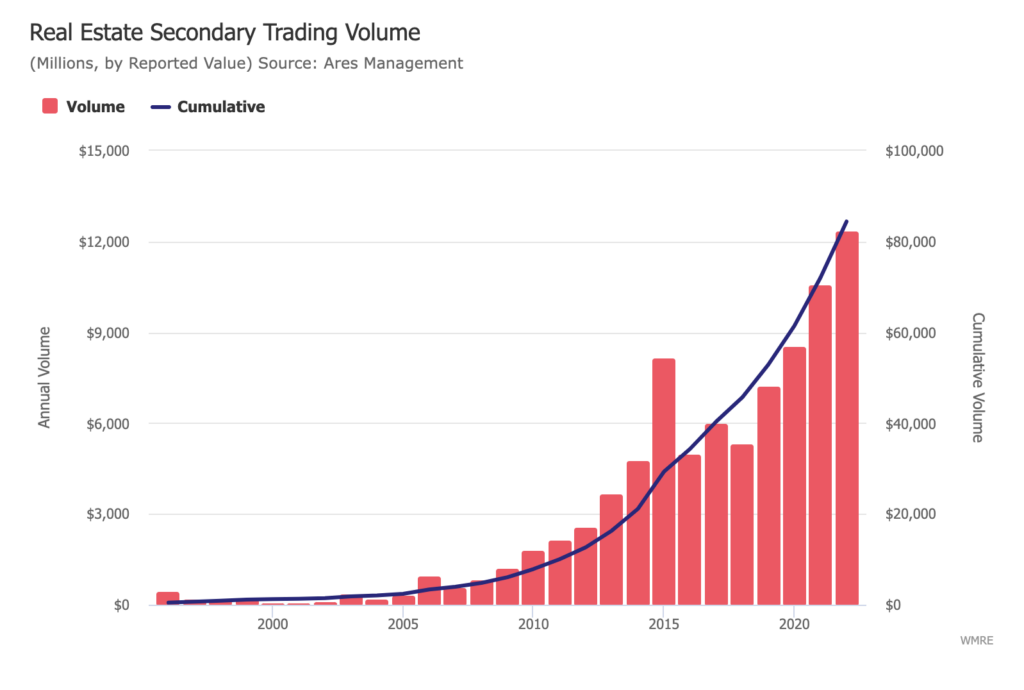

The real estates secondary market set a record last year with $12.4 billion in global sales, according to alternative investment manager Ares Management. The firm expects the market to remain highly active in 2023, even in the face of a much more uncertain outlook for commercial real estate. The $12.4 billion volume last year marked a 17% increase over 2021 and a 71% increase over the last pre-pandemic year, in 2019, Ares reported. In 2024, transaction volume is expected to continue to grow, according to Jamie Sunday, partner and co-head of real estate secondaries at Ares Management.

“Transaction volume is really poised for meaningful continued growth,” Sunday said. “Everything going on in the market environment will be an added catalyst for opportunities.”

“We’re still in the middle of the price discovery phase,” DiSalvo said. “The things that are getting done are smaller repriced transactions and portfolios of high-quality assets when there’s assumable debt in place at favorable terms. Those are getting executed, but it’s pretty quiet while we’re in price discovery. As we reach the tail end of the Fed hiking cycle, we are aware of many managers who are planning large transactions whether they’re fund continuations or portfolio recaps targeting late 2023 and early 2024.”

General partner (GP) sponsors are increasingly looking to the secondary market as an alternative to provide liquidity for limited partners (LPs) and fund vehicles. They are tapping the secondary market to raise capital to safeguard their portfolios and provide additional time and money to continue to realize business plans and achieve strategic objectives, industry experts said.

According to Ares, GP-led transactions involving the recapitalization of funds and property portfolios reached a record of $9.5 billion in 2022, and made up 77% of the total secondaries sales volume.

Because of the tightening in the capital markets over the course of recent months, GPs are looking at the secondary market to recapitalize their investment and buy themselves some time until they can sell the whole thing down, said Sunday.

GPs “would prefer not to sell their assets right now, so that would make them more motivated to seek recap solutions for their portfolio needs,” agreed David Lei, managing director of BGO Strategic Capital Partners, a global multi-manager platform. The difficult fundraising environment, with the ongoing shortage of credit and depressed pricing for assets is driving more secondary market deal flow, he said.

“This is a very exciting and interesting time for the real estate secondary market that’s most comparable to what we saw during the last global financial crisis that was a catalyst for growth. That’s not surprising. Secondaries are liquidity solutions, and when there’s illiquidity in the market, different types of investors, whether LPs or GPs, turn to the secondary market for solutions.”

About 1.5% to 2% of private equity real estate net asset value (NAV) will likely trade on the secondary market in 2024, or approximately between $13 billion and $18 billion, according to Michelle Creed, a partner and co-head of real estate secondaries at Ares.

LP activity

The situation looks a big different when it comes to LPs. Transactions driven by LPs selling their interests in value-added and opportunistic funds declined in 2022, totaling approximately $1.1 billion, according to Ares.

However, increasing market volatility and the denominator effect many LPs are going through might serve as an enhancement to deal flow that could propel volumes meaningfully higher in 2023 than they were historically, Sunday said.

The drying up of distributions is impacting LP liquidity and their capacity to invest in what should be a strong vintage year, following to those immediately following the Great Financial Crisis, he noted. In addition, the decline in the stock market in 2022 caused a lot of LPs to be overallocated to private assets. Selling in the secondary market can be “a relief valve,” where LPs can manage those allocation pressures and free up capital, he added.

Who buys and sells secondaries

The sellers of real estate secondaries tend to be diverse, but some of the most active are endowment or foundations who manage their portfolios more proactively, Lei said.

The primary buyers in the market are dedicated funds whose investors range from high-net-worth individuals to institutional investors who view secondaries as an attractive opportunity, according to Lei.

In fact, the pool of buyers has grown at an impressive rate over the last five years, according to Warren Kotzas, a partner with Park Madison Partners. Prior to that, it was a handful of specialists. Today, that number has more than doubled and more entrants are on the way.

“We expect the pool of capital that are specialized to engage in these types of transactions to continue to grow,” Kotzas said. “There are a number of vehicles out there raising today. More exciting, non-specialists are getting more active over time. Insurance companies and non-traded REITs, asset managers, family offices and sovereign wealth funds are all seeing this as a way to access real estate in a very direct way and get exposure to assets they like.”

Five to 10 years ago, there were more questions about the process and complications, Kotzas said. While the market for real estate secondaries has existed as long as real estate private equity funds have existed in order to provide liquidity for LPs, it was the Global Financial Crisis that was the catalyst for the market becoming institutionalized, according to Lei. Since then, the sophistication of the buyers has increased and broadened the pool, Kotzas noted.

“We’re in a really exciting time for our market,” he said. “A lot of what the market is facing in terms of dislocation and repricing of debt, the secondary market is an excellent place to go find solutions in the current environment.”

Current pricing

The pricing of secondaries is typically quoted to the last reported fair market NAV, and they almost always price to a discount, reflecting the need for a liquidity premium, according to Lei. The amount of NAV outstanding today totals about $900 billion, Ares Management reported.

Currently, these discounts can range from 25% to 50%, depending on the characteristics of the fund. What property types the fund carries, the fund manager, geographic exposure, the fund vintage and potential upside all affect pricing, he said. For example, funds focusing on industrial or student housing sectors are pricing at lower discounts than funds carrying office properties.

Discounts tend to be high because fund NAVs lag in terms of valuation, noted Sunday, who also assessed the discount range as being between 25% and possibly more than 50%. As markdowns funnel through valuations over the next few quarters, the pricing discount optics will improve, he added.

“Something that is priced to a 40% discount off a 9/30/22 NAV may drop to a 20% to 25% discount to 3/31/23 based solely on the NAV markdowns” Sunday said. “That will be an added catalyst for LPs that really want to transact and create some liquidity, but have optical thresholds to contend with.”