PitchBook

The private equity secondaries market is primed to boom next year.

LP demand for liquidity, driven by the denominator effect and a dry exit market, is expected to push record levels of deal flow in the private equity secondary market, according to secondaries-focused consultants, advisers and managers.

The flow of secondaries will swell to those levels despite sellers’ reluctance to accept the discounts imposed on them by buyers, as the price of liquidity mounts.

“Expectations are high that the secondary market will hit a record year in 2023,” said Cari Lodge, managing director and head of secondaries at Commonfund Capital.

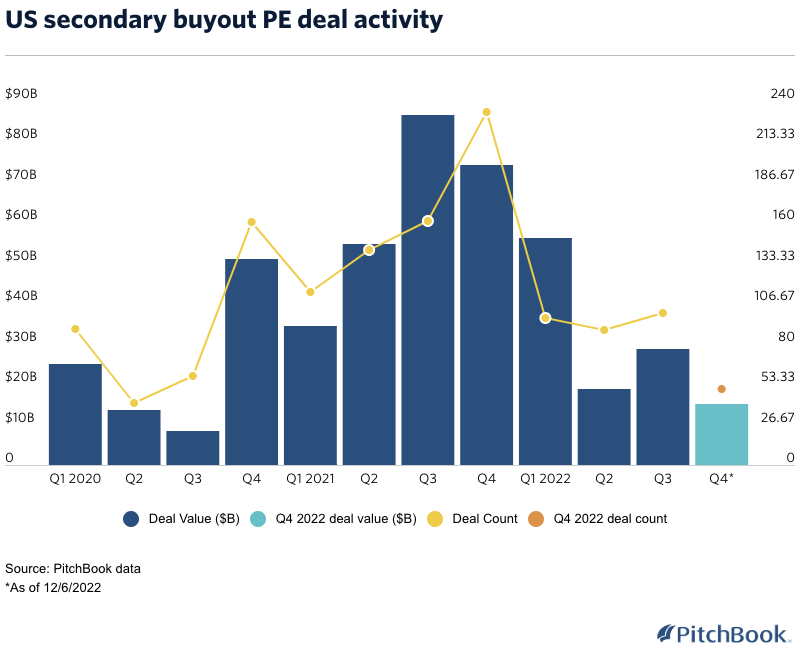

Secondary transactions reached new highs in 2022, hitting $57 billion in total volume in the first half of the year and surpassing the previous record of $48 billion in the first half of 2021, according to Jefferies’ global secondary market review.

But in the second half of 2022, when the public markets took a nosedive, institutional investors found themselves over-allocated to private equity because of the denominator effect. Over-allocated investors needed to free capital locked up in longer-term PE investments, but, in recent months, traditional exit routes proved challenging for PE firms.

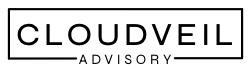

In fact, US PE investors logged around $293 billion in exits through the end of the third quarter, a significant drop from 2021’s $863 billion. Belabored with the denominator effect and a nearly frozen IPO market, both LPs and GPs turned to the secondary market as an alternative liquidity option.

This liquidity demand is expected to continue in the new year.

“There are a number of investors that are looking to liquidate some assets,” said Christine Patrinos, a founding partner at Mozaic Capital, a boutique secondaries advisory firm. “If they’re not going to sell a company or take it public, then the GP-led continuation fund is really another liquidity option for GPs to have in their toolkit.”

Broader macroeconomic uncertainty is also driving deal flow to secondaries. Volatility in the public markets and uncertainty around interest rates and inflation have combined to trigger anxieties for investors, who largely build their private market portfolios based on a percentage of their overall portfolio. With this percentage fluctuating, private market investors find their freedom to plan and manage their portfolios is limited.

Here, secondaries act as a sort of refuge, working as an alternative liquidity source and providing “flexibility” to investors to maneuver their portfolios in times of uncertainty, said Tom Kerr, managing director and global head of secondaries at Hamilton Lane.

“It’s that backdrop which is driving this deal flow and activity,” Kerr said. “The tailwinds, in terms of deal flow and volume and activity for secondaries, have never been stronger.”

Secondary transactions will experience some difficulty in pricing in 2023, specifically with getting buyers and sellers to agree on an asset’s value. The secondary market is expected to close out 2022 with lower transaction volumes in the second half of the year, as buyers lower offering prices in response to inflated net asset values and sellers fail to adjust their expectations.

“With bigger discounts in the market now, the sellers hit pause. We saw a number of transactions that were pulled, where sellers thought they wanted liquidity but weren’t willing to take the discounts required to generate that liquidity,” said Anthony Shontz, partner and co-head of private equity integrated investments at Partners Group.

Over the course of the next year, Shontz said he expects sellers to grow more receptive to lower prices, accepting 15% to 20% discounts as “just the price of liquidity.” Once that happens, likely in the second half of 2023, transaction volumes will grow, he said.

Paul Cohn, managing partner at Tail End Capital Partners, a private equity firm that focuses on GP-led secondary transactions, said he expects 2023 to outpace 2022 in GP-led secondary transaction deal volume and size. Additionally, Lodge, Patrinos, Kerr and Shontz all said they expect to see record transaction volumes on both the LP- and GP-led sides.

As the market continues to accept secondaries as a mainstream liquidity option, the secondaries market is also expected to experience tremendous long-term growth.

“The secondary market is poised to double in the next five years,” Lodge said.

Featured image by Monster Ztudio/Shutterstock